European markets closed higher on Tuesday, recovering slightly from weak trading in the previous session. The European Stoxx 600 index closed up by 0.43%, with the majority of sectors in the region ending in positive territory. Travel and entertainment stocks rose by 1.7%, leading the gains, while the oil and gas sector stabilized after Monday’s gains, which were driven by concerns about shipping in the Red Sea.

FedEx lowered its revenue outlook for the entire year on Tuesday as it competes with United Parcel Service and other rivals in what appears to be a weak holiday season. Its stocks dropped by nearly 8%, and FedEx now expects a 10% decline in last year’s revenues, compared to its previous forecast of nearly steady results.

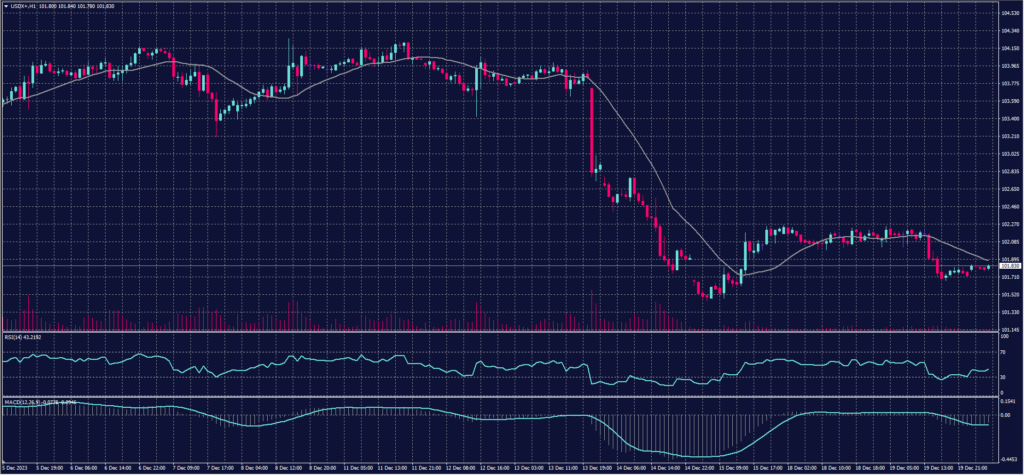

The dollar index declined by 0.4%, while yields on U.S. ten-year Treasury bonds hovered near their lowest levels since July. The markets are anticipating about a 75% chance of an interest rate cut in March, according to the CME FedWatch tool.

| Resistance level | Support level |

| 102.10 | 101.50 |

| 102.45 | 101.30 |

| 102.65 | 100.95 |

On Tuesday, gold prices experienced an uptick as the U.S. dollar weakened and Treasury yields saw a decline. Investors are eagerly anticipating a slew of U.S. economic data set for release this week, which holds the potential to offer greater clarity regarding the trajectory of interest rates.

The spot price of gold increased by 0.6% to $2,038.59 per ounce. Futures contracts for gold settled higher by 0.6% at $2,052.1.

| Resistance level | Support level |

| 2050 | 2025 |

| 2061 | 2010 |

| 2076 | 2000 |

U.S. indices closed with collective gains in Tuesday’s session, propelled by the prevailing enthusiasm for interest rate cuts in the markets, despite attempts by policymakers at the U.S. Federal Reserve to temper this excessive optimism.

The Dow Jones index climbed approximately 0.7%, equivalent to 252 points, in Tuesday’s session, marking its ninth consecutive daily gain and closing above 37,500 points for the first time in its history. Additionally, the S&P 500 index rose by 0.6%, closing at 4,768 points, with major sectors experiencing across-the-board increases. The energy sector led the gains, surging by 1.4%, coinciding with a rise in oil prices.

| Resistance level | Support level |

| 38020 | 37720 |

| 38130 | 37525 |

| 38320 | 37420 |

Oil prices rose on Wednesday, following a more than 1% increase in the previous session, driven by concerns over global trade disruptions and geopolitical tensions in the Middle East following Houthi attacks on ships in the Red Sea.

Brent crude futures gained six cents, or 0.1%, reaching $79.29 per barrel. Meanwhile, West Texas Intermediate (WTI) crude stood at $74.11 per barrel, up 17 cents, or 0.2%.

| Resistance level | Support level |

| 75.00 | 72.70 |

| 75.85 | 71.25 |

| 77.30 | 70.40 |

This article provides real-time market analysis from contributing analysts. Please note that any views expressed in this article do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this article.

Dear Valued Client, Please be advised that the following CFD instruments will be automatically rolled…

Dear Valued Clients, Please be advised that the following instruments' trading hours and market session…

Dear Valued Client, Please be informed that the trading hours for the following products will…

Dear Valued Clients, Please be advised that the following instruments' trading hours and market session…

Dear Valued Client, To further enhance your trading experience, STARTRADER will be conducting a scheduled…

Dear Valued Client, Please be informed that the trading hours for the following products will…

This website uses cookies.